Interest in federal deposit updates for 2026 has increased as people notice changing payment statuses, delayed deposits, or online claims about new government payments. To avoid misinformation and false assumptions, it is important to understand that federal deposits follow strict legal and administrative procedures. This article explains the verified facts, how federal deposits are actually issued, and the roles of the Internal Revenue Service and the U.S. Department of the Treasury.

Is There Any New Federal Deposit Program in 2026

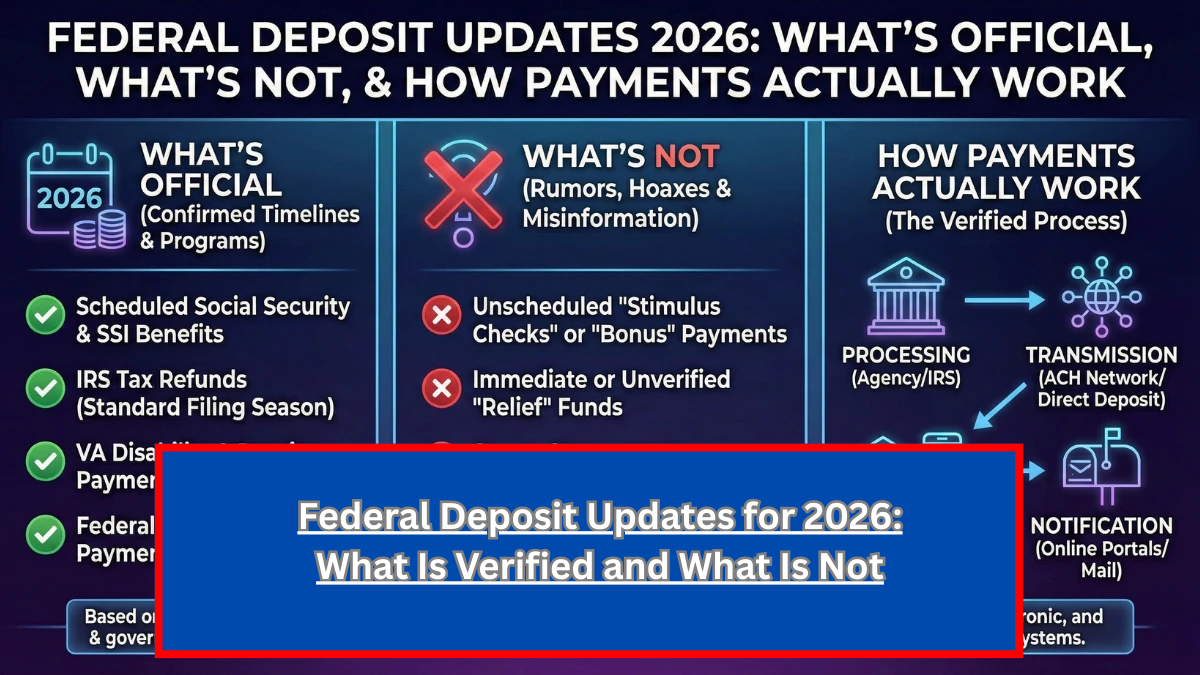

As of now, there is no new universal federal deposit program approved for 2026. Federal payments can only be issued after Congress passes legislation, funding is authorized, and federal agencies publish official guidance. Without these steps, no new automatic or nationwide deposit can occur.

Common Federal Deposits That Already Exist

| Deposit Type | Issuing Authority |

|---|---|

| Tax refunds | Internal Revenue Service |

| Social Security benefits | Social Security Administration |

| Supplemental Security Income | Social Security Administration |

| Veterans benefits | Department of Veterans Affairs |

| Federal pensions | U.S. Department of the Treasury |

Why Federal Deposit Amounts or Statuses Can Change

Federal deposits may appear delayed, pending, adjusted, or updated due to routine processing. These changes usually reflect verification checks, corrections to records, or standard banking timelines. They do not indicate the creation of a new benefit or special payment.

How Federal Deposits Are Processed

Federal payments are released by the U.S. Department of the Treasury after authorization from the administering agency. Once funds are released, individual banks determine when deposits are posted to accounts. As a result, a payment may be sent on time by the government but appear later in a recipient’s bank account.

What Federal Deposits Are Not

Federal deposits are never issued through social media posts, private websites, or unofficial sign-up links. No government agency sends surprise payments without legal approval and advance public notice.

How to Stay Informed Safely

Individuals should rely only on official agency websites, mailed notices, or direct communications from federal agencies. Any claim promising guaranteed deposits, early access, or exclusive eligibility should be treated with caution.

Key Facts to Remember

- No new universal federal deposit is approved for 2026

- All federal payments require Congressional authorization

- Banks control when deposits post to accounts

- Status updates do not signal new benefits

- Only official government notices are reliable

Conclusion

Federal deposits in 2026 continue under existing laws and programs. Any new payment would require formal legislation and clear agency guidance before deposits could be issued. Understanding how federal deposits actually work helps individuals avoid confusion, scams, and misinformation.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or tax advice. Federal deposit programs are governed by law and official government notifications.